Irs Approved Mileage Log Printable

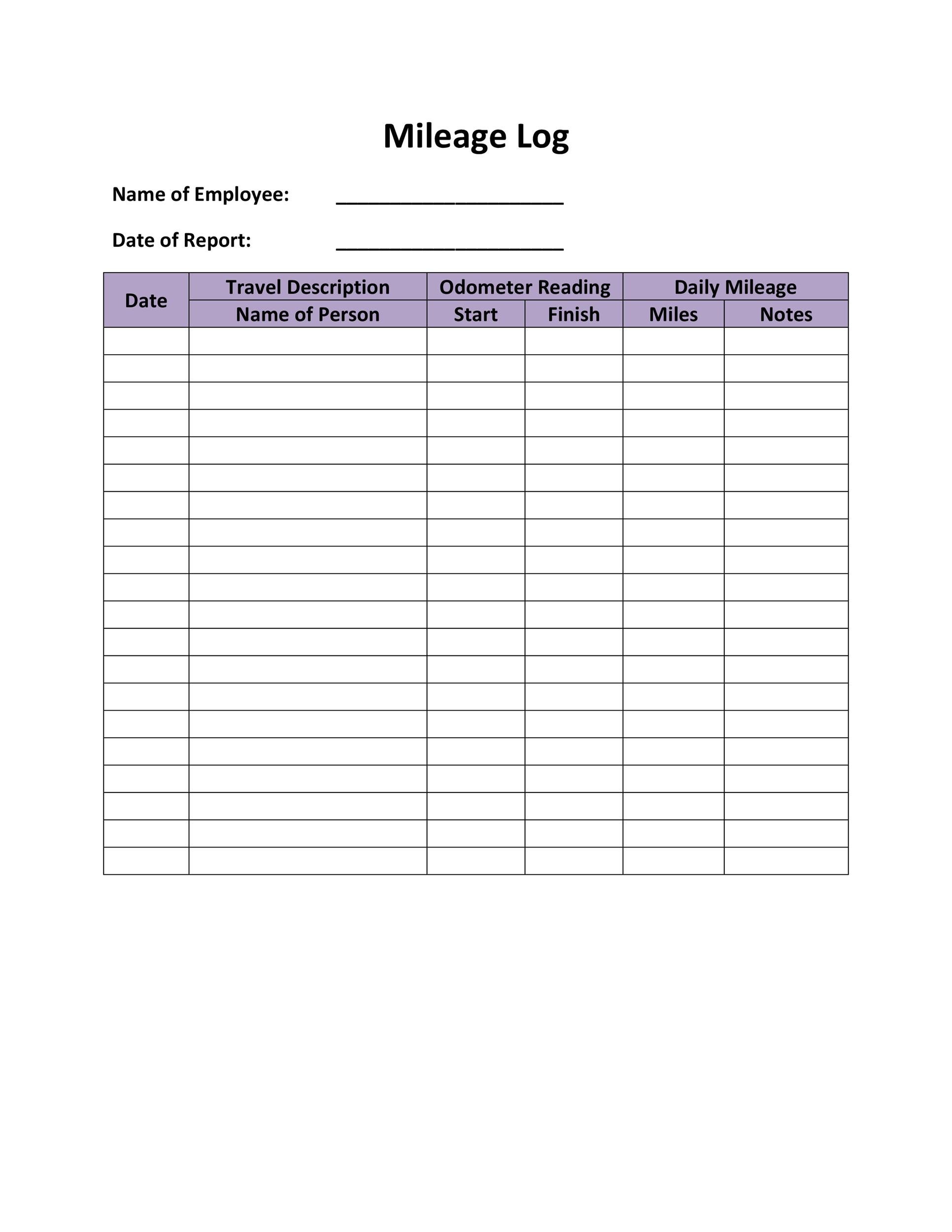

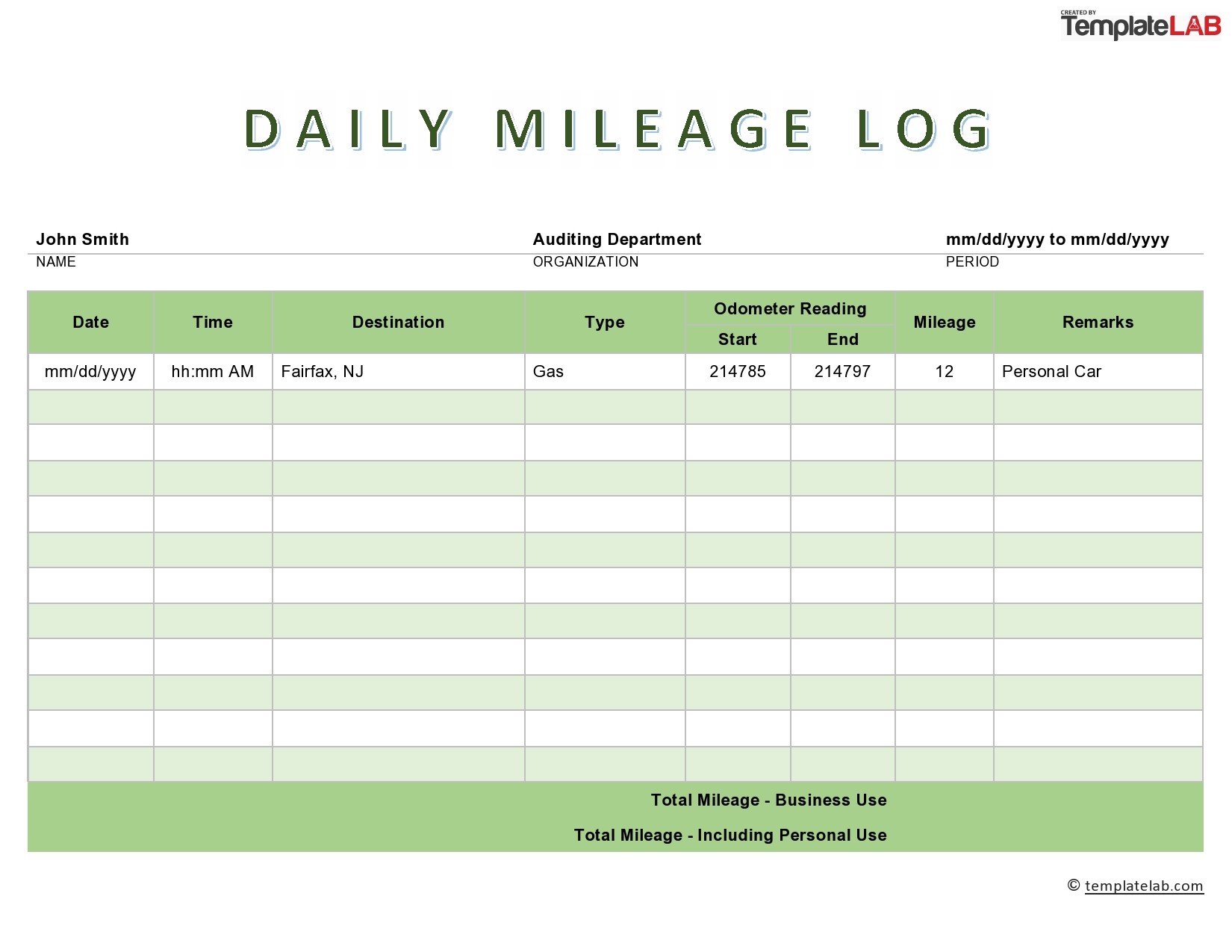

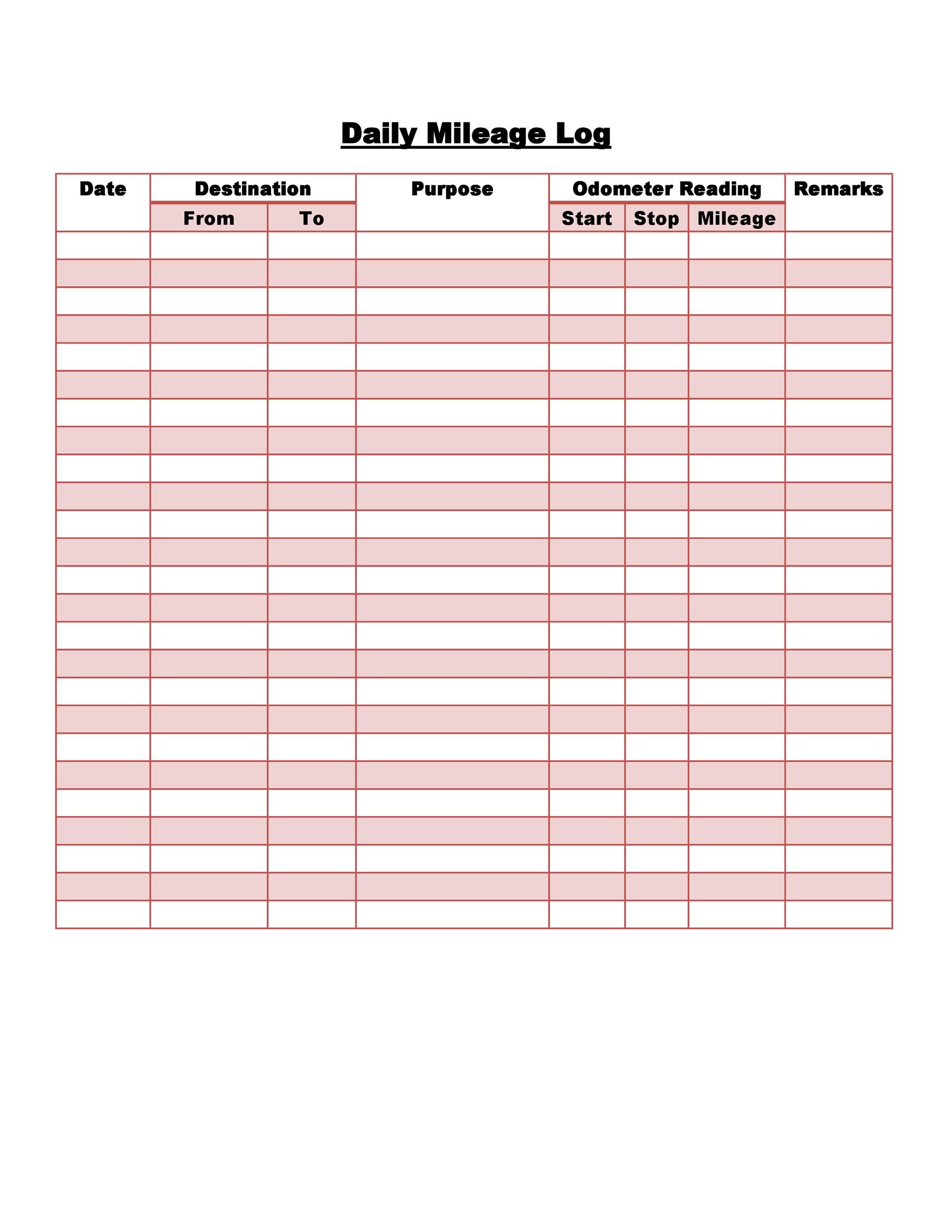

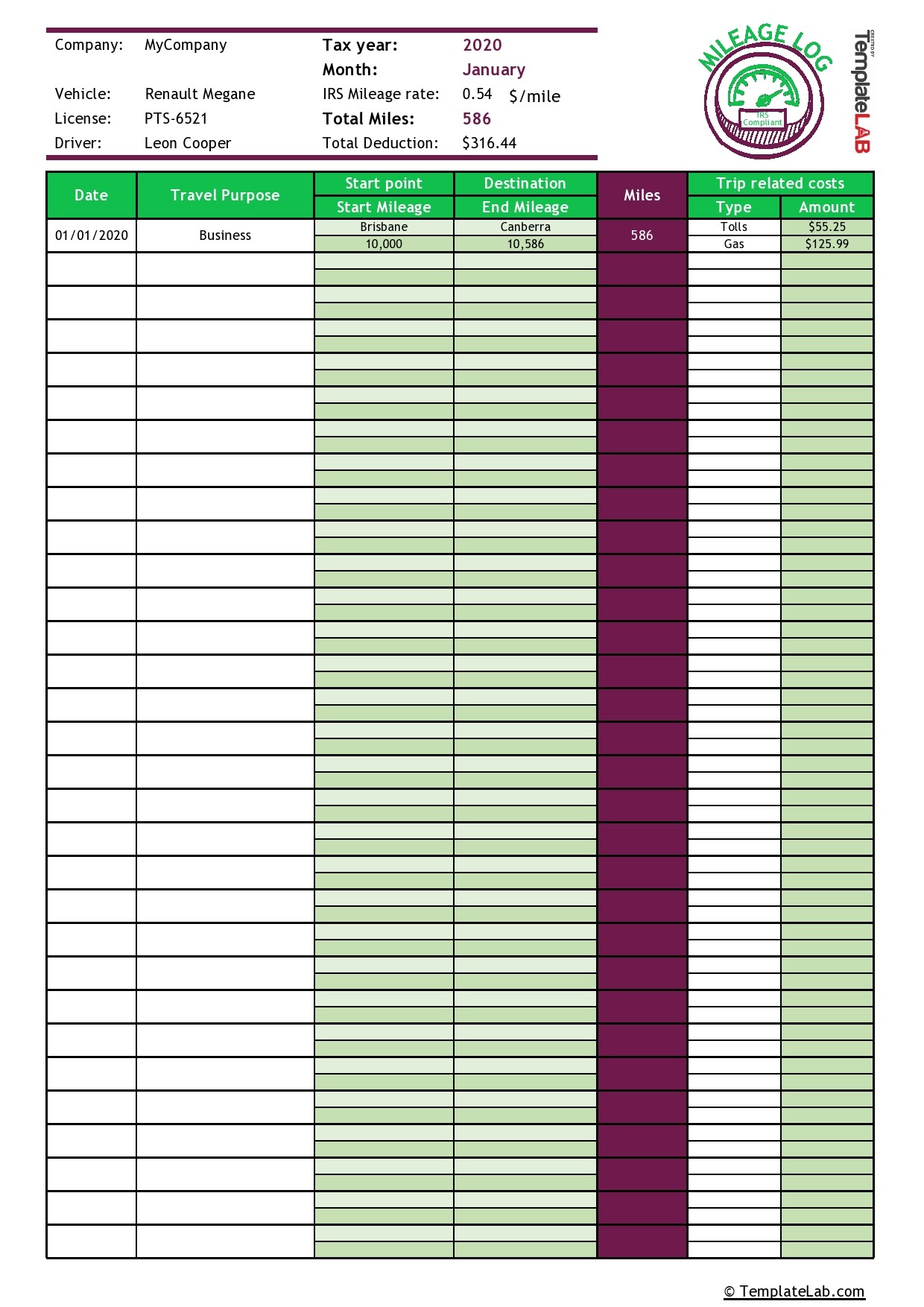

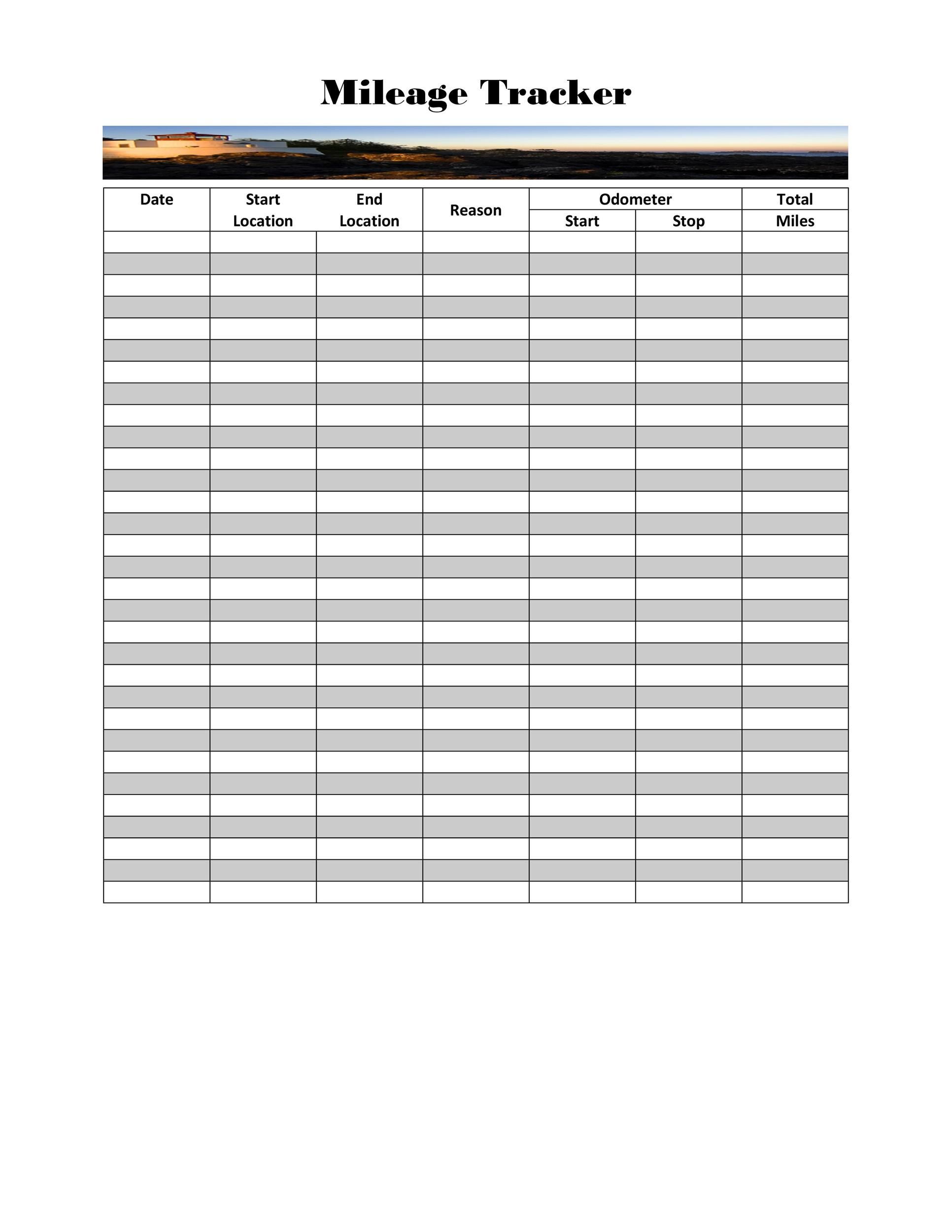

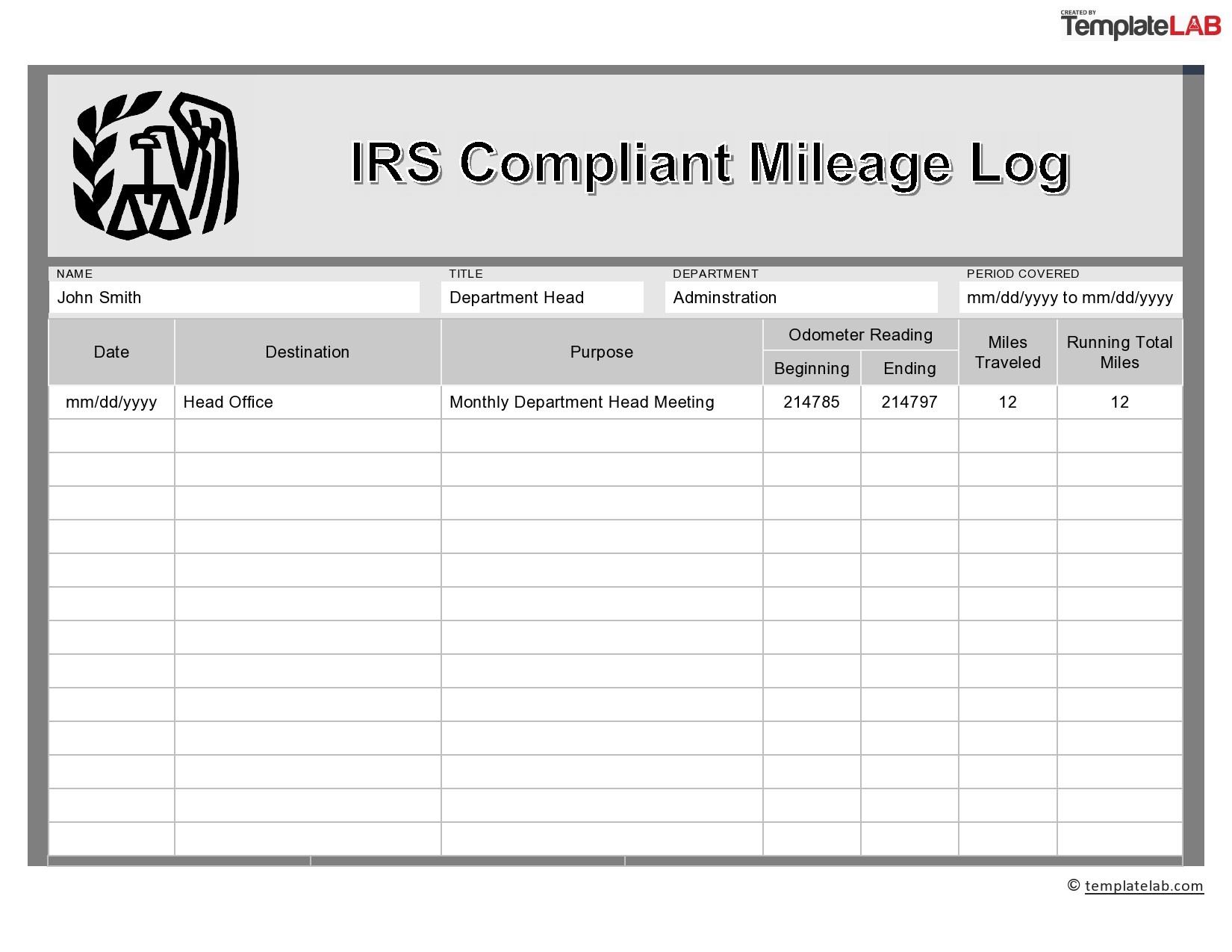

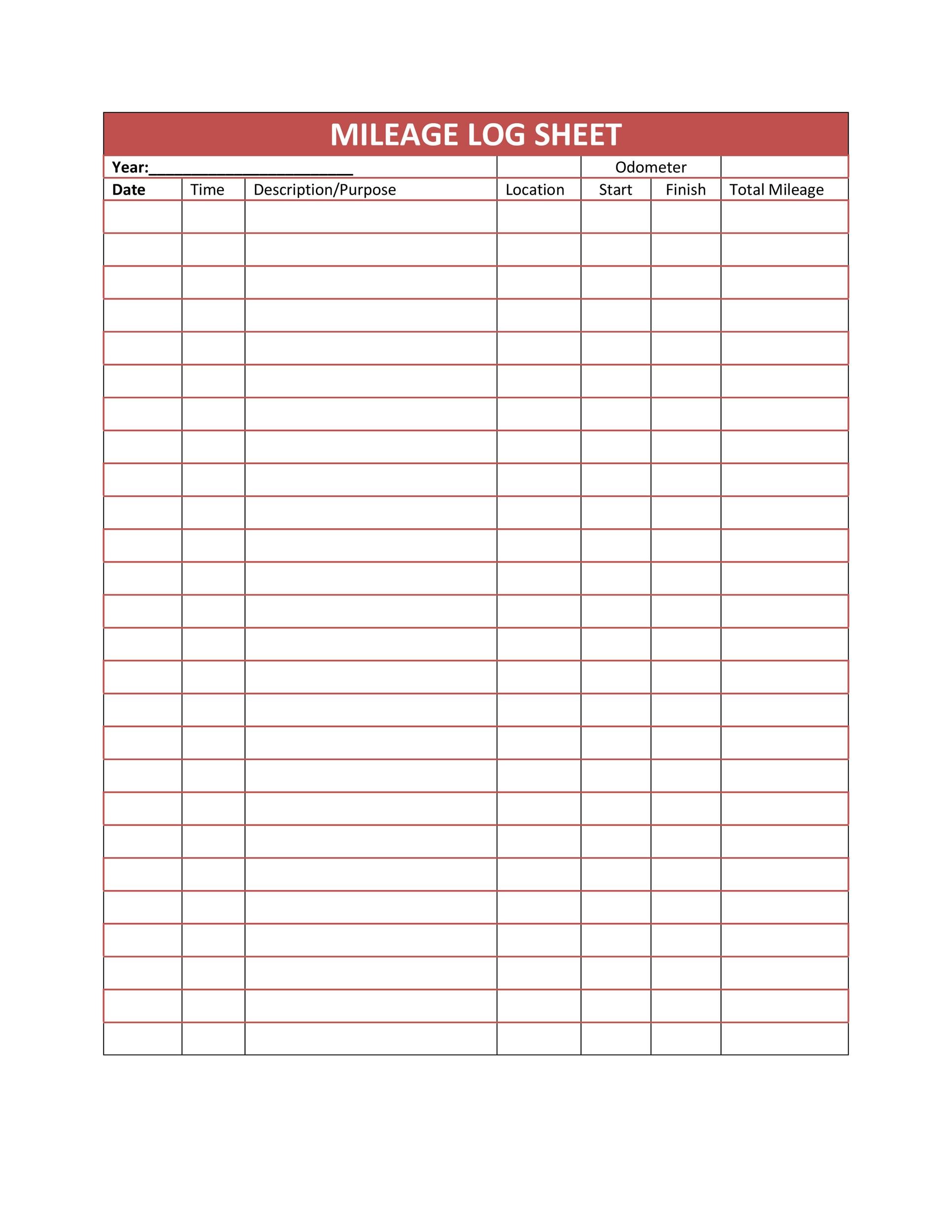

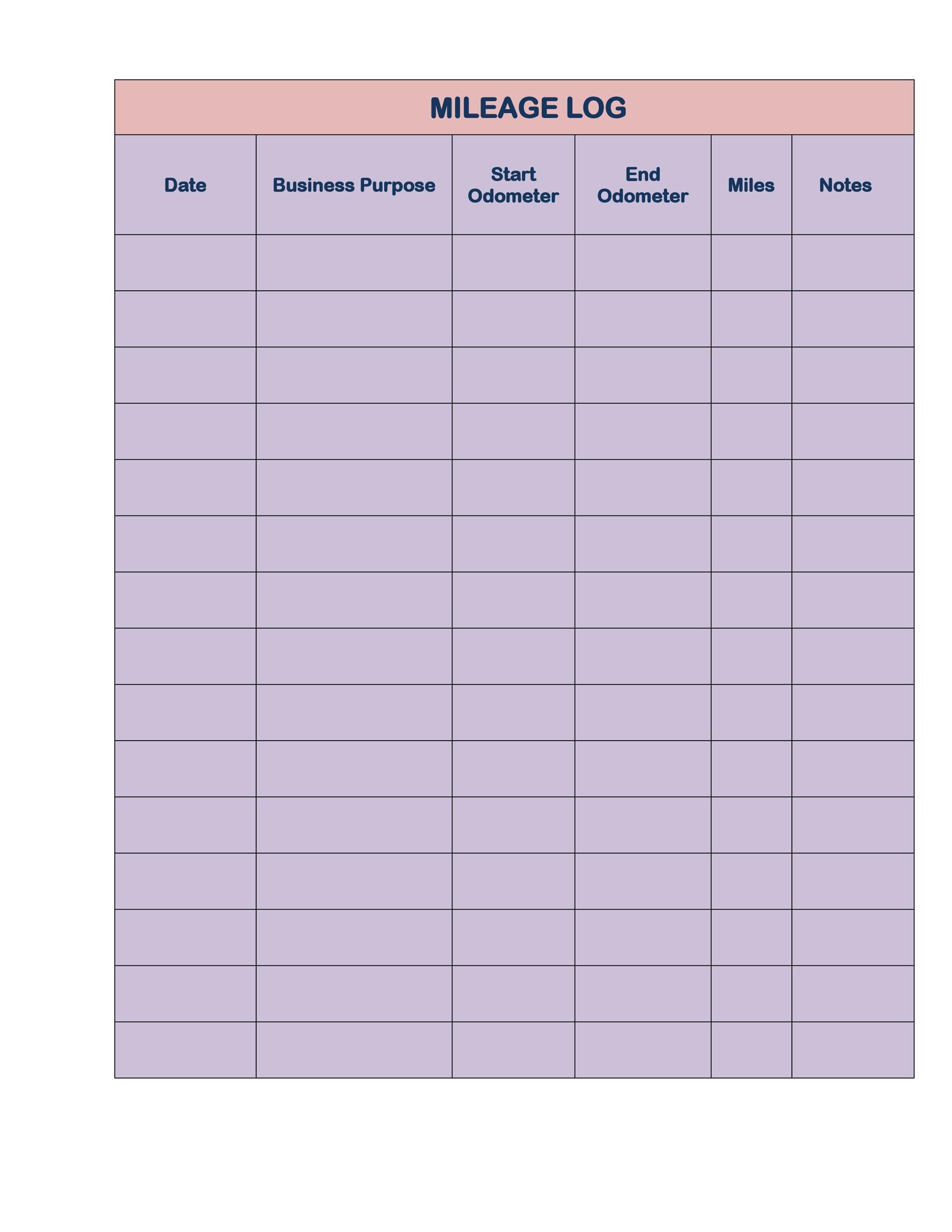

Irs Approved Mileage Log Printable - Powerful tracking that's simple to use and manage. Ad pdffiller.com has been visited by 1m+ users in the past month Benefits of irs approved mileage logs. See an overview of previous mileage rates. Paper logs and digital logs. Web the irs accepts two forms of mileage log formats: Web avail of the best irs mileage log templates on the internet! Customize smart locations, favorite trips, work hours and more. Web printable mileage log template for 2023. Oct 3, 2023 ah, the mileage tracker. Remember to use the 2022 irs mileage rate if you log trips for last year. Ad pdffiller.com has been visited by 1m+ users in the past month Trusted by over 2 million users. Web your mileage log must include the starting mileage on your vehicle's odometer at the beginning of the year and its ending mileage at the conclusion of. Oct 3, 2023 ah, the mileage tracker. Web washington — the internal revenue service today announced an increase in the optional standard mileage rate for the final 6 months of 2022. Never miss another tax day or lose out on. Customize smart locations, favorite trips, work hours and more. If you choose to use the. Remember to use the 2022 irs mileage rate if you log trips for last year. Web a mileage log template can come in the form of a printed sheet or as a digital spreadsheet. Web august 9, 2022 a mileage log for taxes can lead to large savings but what does the irs require from your records? Benefits of irs. Never miss another tax day or lose out on. Web in other words, if you use the irs’s 2023 standard mileage rate of 65.5 cents per business mile driven, then all you need are the above details and a mileage log to. Web the irs accepts two forms of mileage log formats: Web gofar mileage tracker device and a free. You can use them as per your convenience without the slightest hindrance. Web date miles business purpose if any of those essential pieces are missing, the mileage log is not considered irs compliant. Never miss another tax day or lose out on. Remember to use the 2022 irs mileage rate if you log trips for last year. There are many. There are many places on the internet where printable mileage log. Web washington — the internal revenue service today announced an increase in the optional standard mileage rate for the final 6 months of 2022. Web august 9, 2022 a mileage log for taxes can lead to large savings but what does the irs require from your records? Powerful tracking. See an overview of previous mileage rates. Web 20 printable mileage log templates (free) the irs has strict rules about the types of driving that can be deducted from your taxes. Web august 9, 2022 a mileage log for taxes can lead to large savings but what does the irs require from your records? Web our free mileage log templates. Web in other words, if you use the irs’s 2023 standard mileage rate of 65.5 cents per business mile driven, then all you need are the above details and a mileage log to. Web 20 printable mileage log templates (free) the irs has strict rules about the types of driving that can be deducted from your taxes. You can use. Never miss another tax day or lose out on. Web date miles business purpose if any of those essential pieces are missing, the mileage log is not considered irs compliant. Web gofar mileage tracker device and a free app to log your miles and expenses automatically with no hassle at all or. Follow these best practices to avoid an audit.. You can use them as per your convenience without the slightest hindrance. If you choose to use the. Remember to use the 2022 irs mileage rate if you log trips for last year. Paper logs and digital logs. Paper mileage log a paper log is a simple, written record of your business miles. Powerful tracking that's simple to use and manage. Web avail of the best irs mileage log templates on the internet! Web printable mileage log template for 2023. Web our free mileage log templates will enable you to comply with all irs regulations, thus allowing you to legally and conveniently deduct business mileage expenses. See an overview of previous mileage rates. Trusted by over 2 million users. Follow these best practices to avoid an audit. Web your mileage log must include the starting mileage on your vehicle's odometer at the beginning of the year and its ending mileage at the conclusion of the. Web the irs accepts two forms of mileage log formats: Web date miles business purpose if any of those essential pieces are missing, the mileage log is not considered irs compliant. You can use them as per your convenience without the slightest hindrance. Never miss another tax day or lose out on. Web in other words, if you use the irs’s 2023 standard mileage rate of 65.5 cents per business mile driven, then all you need are the above details and a mileage log to. Web washington — the internal revenue service today announced an increase in the optional standard mileage rate for the final 6 months of 2022. Oct 3, 2023 ah, the mileage tracker. Paper mileage log a paper log is a simple, written record of your business miles. Web august 9, 2022 a mileage log for taxes can lead to large savings but what does the irs require from your records? Paper logs and digital logs. Remember to use the 2022 irs mileage rate if you log trips for last year. Benefits of irs approved mileage logs.30 Printable Mileage Log Templates (Free) Template Lab

31 Printable Mileage Log Templates (Free) ᐅ TemplateLab

31 Printable Mileage Log Templates (Free) ᐅ TemplateLab

20 Printable Mileage Log Templates (Free) ᐅ TemplateLab

25 Printable IRS Mileage Tracking Templates GOFAR

31 Printable Mileage Log Templates (Free) ᐅ TemplateLab

25 Printable IRS Mileage Tracking Templates GOFAR

31 Printable Mileage Log Templates (Free) ᐅ TemplateLab

30 Printable Mileage Log Templates (Free) Template Lab

31 Printable Mileage Log Templates (Free) ᐅ TemplateLab

Related Post: